Grant Thornton has released a report on the contribution of mid-sized business to Australia – highlighting how initiatives and strategies geared to support and grow this segment could have a tangible impact on the Australian economy in just five years.

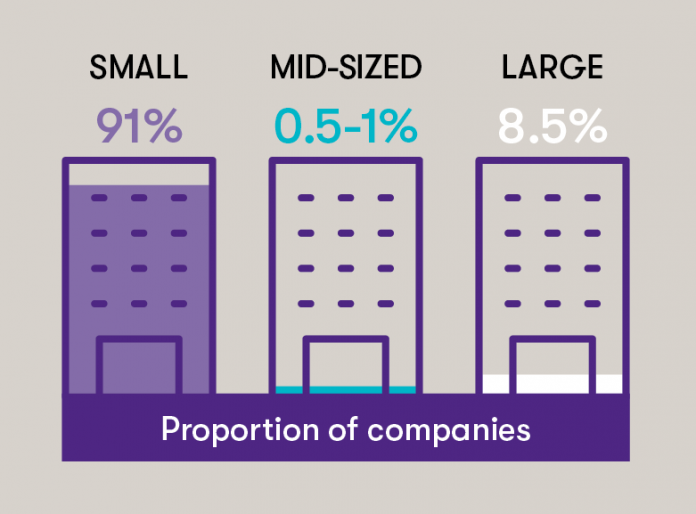

The report has found that mid-size businesses account for less than 1% of Australian businesses, yet nearly 20% of company tax.

This is largely because ABS data categorises businesses by numbers employed as key indicator for size instead of revenue.

“ABS data categorises businesses by numbers employed – however, a technology company with 10 people can generate the same kind of revenue as a manufacturing company employing 400. Revenue should be key indicator for size – and mid-sized should range between $50m – $500m,” reads the report.

“Political rhetoric from both sides talks about supporting small business – representing approximately 90% of businesses in Australia. We also hear about big business paying their fair share – representing approximately 9% of businesses in Australia.

“It is easy to understand then, how mid-sized business, representing less than 1% of Australian businesses has slipped through the cracks. But they shouldn’t.”

Greg Keith, CEO of Grant Thornton Australia described Australia’s mid-sized business as ‘the forgotten child’, referring to the lack of real data on the size or impact of this segment on the Australian economy.

“As the leading advisors for mid-sized business we support clients every day that are too big to access many of the benefits afforded to small business, and are too small to carry the same tax and regulatory burden as big business,” Mr Keith continued.

“Access to some tax incentives dry up the bigger your business becomes. This is counterbalanced with increased rigor around regulation and reporting. The same requirements we have for the big multi-nationals operating in Australia also apply to family run businesses with operations across two states,”

“The positive news is that mid-sized business are more adept at taking advantage on new market opportunities – having the scale to invest more into their business without issues around legacy. With more incentives and investment – an achievable and one-off 10% in revenue growth in one year has exponential potential for both the company and the broader economy.”

As part of the study, Professor Neville Norman, Economist at the University of Melbourne and Cambridge University simulated an exercise for the impact a 10% boost would have on a “typical” $100m mid-sized business.

The simulation resulted in sales revenue going up by 10%, profits rising by $15m or 20%, and company tax payments increase of $5.3m or 25%. Cash-flow of the revenue-boosted company also went up by $35m or 35%.

“Of course, the way to achieve this 10% growth will be different depending on your industry, and how they are funded,” notes the report.

“Our industry leaders have contributed their top three recommendations – for both policy change and business investment – to support sustainable growth for the following sectors: Consumer Products & Retail, Education, Energy & Resources, Financial Services, Food & Beverage, Health & Aged Care, Life Sciences, Manufacturing, Professional Services, Real Estate & Construction, and Technology & Media.”

The report also outlines several recommendations to help boost the manufacturing sector. It notes that initiatives like R&D and ensuring Free Trade Agreements complement local manufacturing can help boost the sector.

“Manufacturing punches above its weight in terms of investment in R&D – with one figure stating that $4.8b was spent by the manufacturing industry in 2013-14 – as a proportion of GDP this is roughly four times the economy wide average,” it says in the report.

“Australians like to buy locally – but if a competing product from overseas is available at a significantly reduced price (for instance 100% of China’s exports to Australia are exempt from tariffs) then it becomes more difficult to compete.”

The full report is available here.