Defence and aerospace company Electro Optic Systems (EOS) has ventured into a financing agreement with major shareholder Washington H. Soul Pattinson and Company (WHSP) to support its restructuring efforts.

According to EOS’ financial report for the first half of 2022, the company signed a financing agreement with WHSP to refinance an existing $35 million loan.

The agreement also provided an additional $20 million working capital facility to support the restructuring of EOS’ core defence and space unit.

“The Company expects to continue to work with capital providers including WHSP to adapt and transition from these arrangements to a debt and equity structure to meet longer-term working capital requirements,” EOS said in a statement issued Thursday.

EOS’s financial report outlined an operating loss after tax of $98.9 million for the first half of 2022.

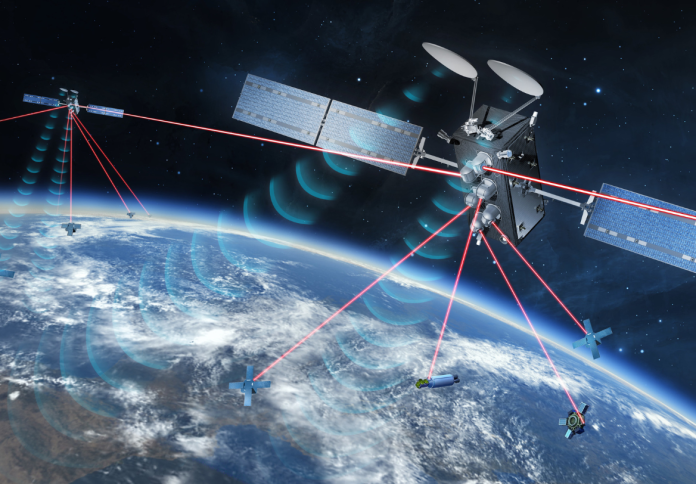

A significant component of the figure, amounting to $54 million, has been attributed to the impairment of assets and onerous contracts held in its US-based satellite systems subsidiary SpaceLink Corporation.

Furthermore, the company saw several executive shifts and executed organisational restructuring to enable a more focused strategy.

EOS said it is continuously exploring opportunities to realise value from the SpaceLink assets and remains and is in active negotiations with potential partners and purchasers.

The company noted that it is in the process of making significant changes in H2 2022 to reverse the earnings before interest and taxes, and cash flow momentum in order to establish a strong platform for 2023.

Among its plans, EOS said it seeks to prioritise existing business lines that are profitable and respond to customer procurement activity, instead of anticipating requirements through customer planning documents.

EOS added that it executed contract changes to streamline the invoicing and payment processes, which is expected to result in a recovery in the company’s cash position in H2 2022.