Aerospace and composites manufacturing giant Quickstep Holdings has generated total revenue of $45.4 million for the first half of fiscal year 2023, which ended 31 December 2022. This figure marks a 4 per cent decrease on the previous comparative period, which stood at $47.3 million.

In an ASX announcement issued Tuesday, the company said its performance for H1 FY23 was impacted by ongoing operational challenges, which included industry-wide supply chain disruption, shortages in skilled labour, and specific key equipment reliability issues.

Revenue was also affected by the ongoing investment in the establishment of both the Aftermarket and Applied Composites lines of business, which had a combined loss of $2.7 million, the company said.

“Whilst we are disappointed with the half-year results, they reflect an extremely difficult calendar year 2022 that presented extensive operational challenges, which we do not expect to be replicated in 2023,” said Mark Burgess, CEO of Quickstep.

Amid ongoing challenges, Quickstep said its Aerostructures business has commenced recovery to plan with two of three major programs back to customer schedule

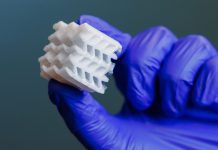

Applied Composites’ production volumes are ramping up after the line of business secured new orders from Swoop Aero, Carbonix, and Spright during the H1 FY23 period.

Meanwhile, Aftermarket continues to face a customer and operating environment still in recovery from the pandemic.

Quickstep said it is looking towards a strong recovery in Aerostructures for the second half of the fiscal year, in addition to additional growth from Applied Composites.

“During calendar 2022 we navigated the parallel challenges of extraordinary absenteeism, broad supply chain risks, equipment reliability and ongoing skills shortages, it was unquestionably a very difficult year for the company,” Burgess said.

“Whilst we are removing previous FY23 financial guidance, the long-term growth thematic for Quickstep remains unchanged. We are excited by the attractive growth opportunities we see for Quickstep and are positioning the company to enable it to deliver on those opportunities.”