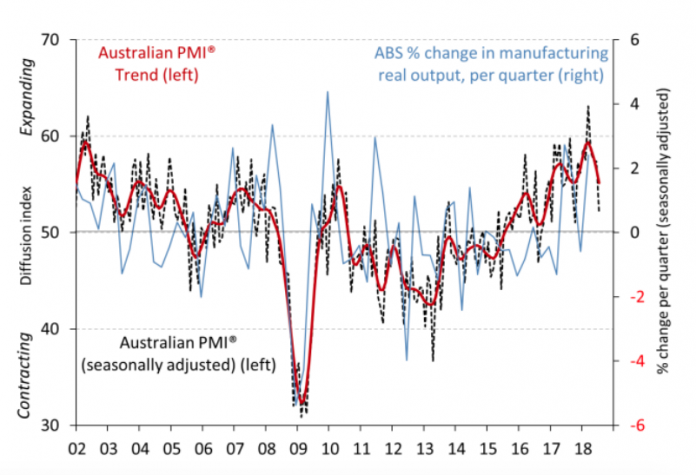

The Australian PMI posted its lowest result in almost five years, having dropped a further 1.1 points to 44.3 in February due to concerns about drought, weak demand from the construction sector and a general slowdown in the economy.

According to AI Group’s survey, coronavirus also emerged as a concern for the first time in February, impacting negatively on the exports of Australian manufactured goods, particularly consumable items into China.

These concerns reflected poorly on six of the seven activity indices in the Australian PMI in February, with employment the only index being broadly stable (up 0.7 points to 49.1).

Production (down 4.8 points to 40.4), new orders (down 2.0 points to 41.7), sales (down 2.3 points to 43.1) and exports (down 5.3 points to 44.5) all contracted at a faster pace than the previous month.

Worse still, all six manufacturing sectors in the Australian PMI experienced weaker conditions in February than in January, with Food & beverages the only manufacturing sector in expansion (down 1.9 points to 55.0).

The input prices index also slowed by 4.5 points to 57.4 in February, falling well below the long-run average for this index of 67.6 (since 2003) and the lowest reading since May 2013.

Although the selling prices index recovered 3.8 points to return to broad stability at 50.4 points, the average wages index, trending down since its recent mid-2018 peak, edged lower again in February dropping down 0.3 points to 54.9.

Ai Group Chief Executive Innes Willox said the results mark the first time the index has recorded four consecutive months of contraction since 2014.

“The manufacturing sector recorded a fourth consecutive month of contraction with the impacts of drought and the devastating bushfires continuing to be a drag on the sector,” Mr Willox said.

“The disruptive effects of the coronavirus, including on supply chains, are deepening and adding to the slowdown that has been in train since the closing months of 2019.

“The large food & beverages sector was the only sector that expanded in February with all other sectors experiencing steeper falls than in January.”