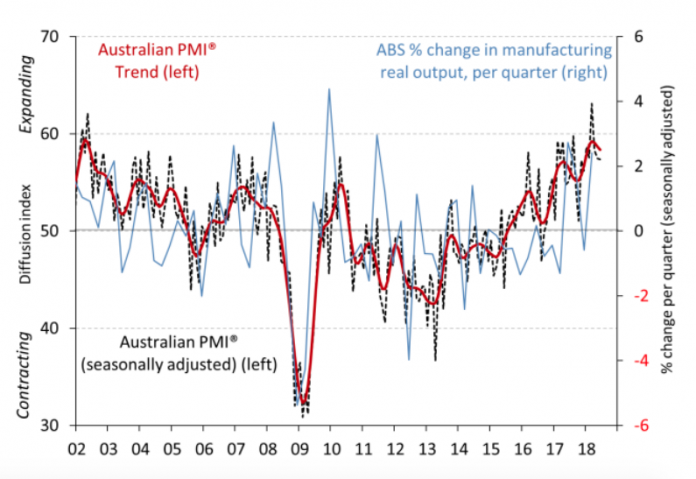

Ai Group’s Australian Performance of Manufacturing Index (Australian PMI) rebounded in July after experiencing the biggest fall since August 2016 in June.

According to Ai Group’s report, Australian PMI rose 1.9 points to 51.3 in July, climbing back into expansion on the back of continued expansion of the food & beverages, chemicals, and building-related products sectors.

The survey’s findings suggest manufacturers are gearing up for more production in coming months, with four of the seven activity indexes in the Australian PMI expanding in July.

Sales slipped 8.1 points to 42.7 and production fell 3.6 points to 48.3, while the new orders index went up 3.2 points to 53.0 and supplier deliveries returned to positive territory (up 4.8 points to 51.9).

The exports index improved again in July (up 1.5 points to 54.6), with strong overseas demand for Australian consumable manufacturing products such as food, beverages, pharmaceuticals, vitamins and cosmetics.

The report also found that three of the six manufacturing sectors expanded in July, with the gap between the expanding and contracting sectors growing in recent months.

“Food & beverages (down 0.7 points to 59.2) and building materials, wood & furniture (up 1.3 points to 63.7) led the way, while heavy industrial sectors including metals (down 2.9 points to 35.4) and machinery & equipment (up 1.0 points to 48.8) continued to report weak conditions,” reads the report.

The input prices index eased again in July (down 1.1 points to 66.3), while the average wages index fell by 2.8 points to 56.9 in July, indicating a slower rate of wage increases across the manufacturing sector despite the 1 July 3.0% minimum wage rise.

Commenting on the report, Ai Group Chief Executive Innes Willox said:

“Australian manufacturing edged back into growth in July as continued expansion of the food & beverages, chemicals, and building-related products sectors outweighed ongoing deterioration in activity in the metal products and textile, clothing, footwear, paper & printing sectors,” Mr Willox said.

“Machinery & equipment manufacturers moved closer to stabilisation boosted by infrastructure-related sales. While production fell, export sales were stronger partly due to the downward drift in exchange rates over the first half of 2019 and partly due to strong overseas demand for food, beverages, pharmaceutical and cosmetic products.

“Pressures on manufacturers’ margins continued in July in the face of weak domestic sales and selling prices even though the pace of increases in wages and other input costs eased. In encouraging pointers for the months ahead, both new orders and employment expanded in July,” he concluded.