The Judo Bank Flash Australia Composite PMI Output Index posted below the 50.0 no-change mark in August, falling to 47.1 from 48.2 in July, as new orders dipped for the first time in five months.

According to the report, higher interest rates stifled demand for both goods and services, but the labour market remained tight as firms in both sectors increased labour capacity in anticipation of higher output in the next year.

In August, the service sector remained the primary source of private sector weakness, with services activity contracting at the highest rate in 19 months. Manufacturing output, on the other hand, slightly declined.

“The Flash PMI readings provide further evidence that a cyclical slowdown in the Australian economy is underway with another drop in both the output and new orders indexes,” said Warren Hogan, chief economic advisor at Judo Bank.

The most recent drop in activity was tied to a renewed drop in new orders. Both the manufacturing and service sectors had minor contractions in new business in August, with the latter registering its first decrease in new orders in five months.

According to panellists, tightening financial conditions combined with cost of living constraints hampered clients’ ability to spend. This was more noticeable at home, as new export business shrank only marginally, the report noted.

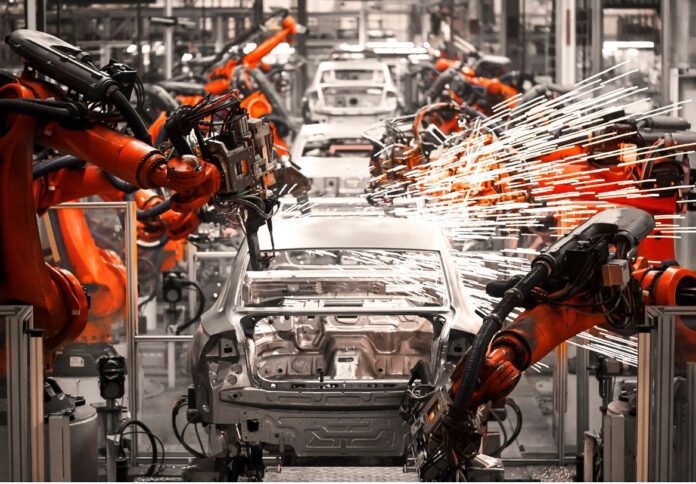

Figures specifically showed the Judo Bank Flash Australia Manufacturing PMI decreased to 49.4 from 49.6 in July.

The index has continued to indicate declining business conditions across the industry, albeit the most recent drop was modest.

“The previously resilient services industries have displayed the most rapid loss of momentum in activity over the past three months, while Australia’s manufacturing sector has stabilised with activity readings just below the neutral 50 level,” Hogan noted.

August saw a slight decrease in manufacturing output as a result of fewer new orders. As a result, businesses reduced their purchasing activities, although average staffing numbers and opinions about the output forecast for the next 12 months also increased.

Australian manufacturers reported their greatest level of business confidence since February.

“Businesses remain confident about the outlook with the future activity index, a proxy for business confidence in the PMI survey, up strongly in August. This renewed optimism will make it less likely that business leaders will look to trim their workforces into a short-lived economic slowdown,” Hogan stated.