Austal has refinanced its debt facilities as part of a broader effort to support its $1.2 billion capital expansion program in the United States, strengthening the company’s position in global defence manufacturing.

The Western Australia-based shipbuilder announced it has secured $488 million in new credit facilities from a consortium of Tier 1 financial institutions, including Australian and international banks, as well as Export Finance Australia (EFA).

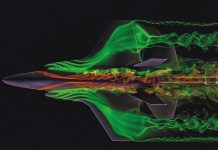

The new facilities are expected to support the company’s major manufacturing expansion projects in the US, including the Final Assembly 2 (FA2) project and the submarine Module Manufacturing Facility 3 (MMF3) project.

Austal said the new debt structure replaces its existing syndicated facilities established in 2015 and delivers improved pricing, extended tenors of five to ten years, and greater financial flexibility to deliver on its $14.5 billion orderbook.

The company is combining the new debt funding with $220 million raised in April 2025 and US$450 million in funding from General Dynamics Electric Boat to support capital investments and maintain working capital.

The EFA loan facility for the FA2 project has been credit approved for up to US$150 million, pending completion of finance documentation and satisfaction of standard conditions precedent.

In a statement, Austal Limited Chief Executive Officer Paddy Gregg said the refinancing marks a key milestone in the company’s strategy to grow its manufacturing footprint.

“The successful refinancing of the Company’s debt facilities positions Austal for the tremendous growth opportunities ahead and reflects Austal’s growth and track record of performance. We received very strong support for this refinancing. Existing and new lenders participated, and better terms and longer tenor were achieved,” Gregg said.

“Austal possesses an exceptional pipeline of long-term defence work in the US, which will be complemented by the Strategic Ship Building Agreement in Australia. The Company now has a stronger balance sheet with enhanced liquidity at a lower cost, longer tenor, and with superior flexibility to support this growth,” he added.

To further strengthen its financial position, Austal has also arranged $634 million of contingent instruments with multiple credit providers and US-based financial institutions.

This is set to backstop the company’s $136 million in Go Zone Bonds and provide commercial guarantees where required.

As part of the refinancing, Austal’s existing $280 million Syndicated Facility Agreement, including a $65 million loan sublimit, will be terminated. The company was advised by Barrenjoey and Norton Rose Fulbright on the transaction.