Australia’s private sector has remained in expansion at the end of the second quarter of the year, despite the manufacturing sector posting below the 50.0 neutral mark in June, according to the Judo Bank’s latest PMI report.

The Judo Bank Flash Australia Composite PMI Output Index reported a 50.5 rating in June, down from May’s 51.6. This marks the third consecutive month the sector posted above the 50.0 no-change mark and indicates a sustained expansion of the private sector, albeit at a slower rate compared to May.

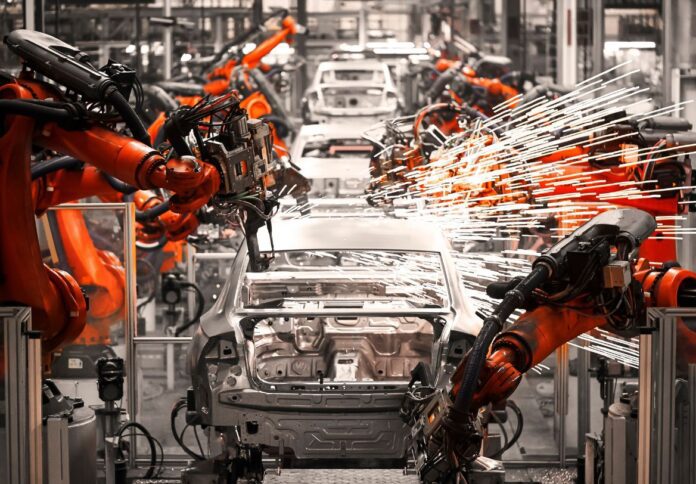

Meanwhile, the Australian Manufacturing PMI remains in the contraction territory, with a rating of 48.6, up from May’s 48.4, indicating that the pace at which Australia’s manufacturing sector contracted further eased in June.

Production shrank at the slowest pace since February amid improvements in supply conditions.

Better vendor performance enabled Australian goods producers to clear their backlogs at the fastest rate in just over three years, Judo Bank said in its report.

New orders remained in contraction, which led to lower input acquisition among Australian manufacturers, thus affecting business confidence.

Similar to the service sector, employment levels continued to grow in the manufacturing industry in June, albeit at a moderated rate. This comes as firms raise their workforce capacity to support ongoing operations and were also able to work through their outstanding work.

The month of June saw an unchanged rate in overall input cost inflation as higher service cost inflation offsets a slowdown in manufacturing input price increases.

The overall rate of cost inflation was above the seven-year series average, which led to the private sector sharing its cost burdens with clients. This resulted in skyrocketing price inflation up to its highest degree since February.

Business sentiment within the Australian private sector remained positive at the end of the first half of 2023, but the level of business confidence fell to its weakest since April 2020 amid concerns over interest rates and the economic outlook.

“The survey suggests that the RBA has time on their side and does not necessarily need to hike rates again in July. The slowdown taking place across the economy provides further evidence that the point at which the RBA can undertake a genuine pause in their tightening cycle is getting closer,” said Warren Hogan, chief economic advisor at Judo Bank.

“We cannot rule out a further hike in the next few months, but we are close to a level of interest rates whereby the RBA can sit back for 4-6 months and observe the effects of past interest rate increases.”