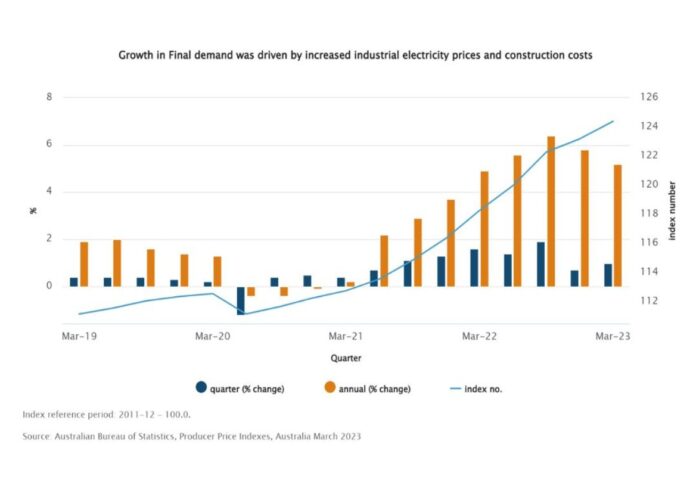

The Australian Producer Price Index has increased by 5.2 per cent in Q1 year-over-year versus a forecasted 5.0 per cent, while input prices to manufacturing rose 0.6 per cent over the quarter and rose 5.0 per cent over the past 12 months.

The Australian Bureau of Statistics revealed one of the main contributors to input price rises to the manufacturing industries was metal ore mining to manufacturing with an additional 6.4 per cent, due to a rise in investor demand for gold, with high inflation and broader economic uncertainty driving more safe haven investment.

Electricity supply to manufacturing reported an increase of 32.9 per cent, due to the pass-through of higher contract prices from rising wholesale electricity prices.

Coal mining to manufacturing rose by 14.7 per cent, owing to increased demand for coking coal as an input to steel production.

Offsetting the rise, were price falls in agriculture to manufacturing with a decrease of 3.9 per cent due to an increase in cattle slaughter rates and a decrease in the cost of stock feed.

Basic chemical production to manufacturing fell by 8.6 per cent due to a fall in the price of caustic soda as demand weakened following historically high prices.

Meanwhile, primary metal production to manufacturing decreased by 3.3 per cent because of the fall in the price of imported iron and steel products following a decline in global economic confidence and the appreciation of the AUD.

According to the ABS, the main contributors to quarterly growth in final demand were electricity and gas supply, which soared by 13.3 per cent, the output of building construction with an increase of 1.1 per cent, and education and training services, up by 3.7 per cent.

However, falling prices in petroleum refining and fuel manufacturing (-7.2 per cent), furniture and other manufacturing (-5.8 per cent), and computer and electronic equipment manufacturing (-3.5 per cent) contributed to the softer annual inflation rate.

Other statistics from Australia included private sector credit, which increased by 0.3 per cent, in line with forecasts.