In a recent report released by inventory management software provider Unleashed, the state of Australian manufacturers is revealed to be in good health overall, with a Manufacturing Health Index score of 63 out of 100.

This marks a successful rebound from pandemic-related challenges, showcasing improvements in supply chain management, stock levels, and overall profitability for the sector, the company said in a media release.

Jarrod Adam, a representative from Unleashed, emphasised that despite various challenges such as overseas competition, market consolidation, and economic constraints, Australian manufacturing remains resilient.

The Manufacturing Health Index, calculated based on sales, expenditure, and overall efficiency metrics, assessed 2,658 manufacturers across 16 different industry categories in New Zealand, Australia, and the United Kingdom.

However, the report also highlighted a growing disparity within the Australian manufacturing landscape, pointing to a ‘squeezed middle class.’

Out of the 16 industries studied, nine scored 39 or below, indicating poorer performance, while seven achieved a health score of 57 or better.

Notably, the report identifies high levels of overstock as a secondary concern for the industry, with Australian manufacturers experiencing an increase in excess inventory, averaging $259,390, up from $244,205 in 2022.

Despite this, some sectors in Australia’s manufacturing industry are thriving, according to the report.

The clothing manufacturing segment, often under negative scrutiny, emerged as the third-best performing market segment with a health score of 96.

The analysis revealed buoyed profitability and a significant reduction in overstock volumes contributed to this positive outlook.

The building and construction industry, despite facing negative sentiment in 2023, displayed strong health with a score of 76, driven by improving overall profitability.

However, the industry continues to grapple with overstocking, which increased to $309,713 from $297,508 in Q3 2022.

In contrast, the cosmetics and personal care industry faced challenges due to consolidation and international competition, resulting in a health score of 13, the lowest among the sectors analysed.

Meanwhile, New Zealand’s cosmetics brands achieved a perfect health score of 100.

The report also delved into the performance of the food and beverage sectors, with beverages scoring 57 and food scoring 31.

Although both sectors experienced a reduction in overstock over the past year, Australian scores surpass those of struggling counterparts in New Zealand.

Despite the varying health positions across different industries, the overall sentiment is optimistic for the Australian manufacturing industry as it heads into 2024.

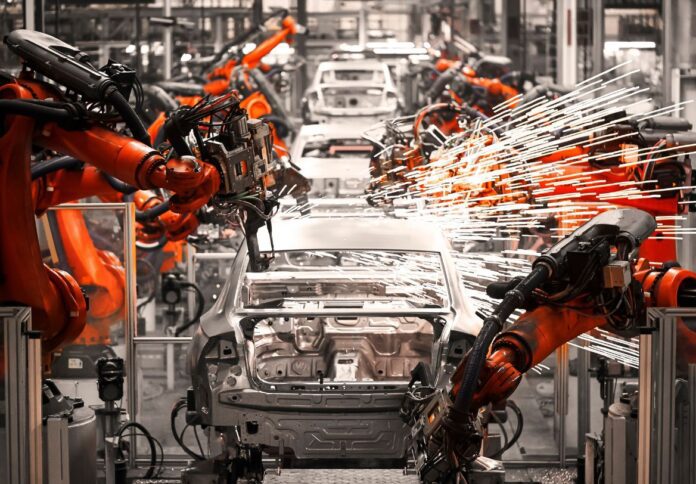

Notably, the Industrial Machinery, Raw Material and Equipment, and Automotive and Automotive Supplies sectors received a perfect health score of 100, indicating their ability to navigate a complex economic environment and maximise operational efficiency.