FBR Limited has announced it has secured access to up to AUD 20 million in funding over the next three years through a Share Subscription Facility (SSF) agreement with GEM Global Yield LLC SCS, aimed at supporting the company’s commercialisation and growth strategy.

In an ASX announcement, FBR said the SSF provides working capital at the company’s discretion, allowing it to draw down funds in tranches in exchange for issuing new shares to GEM.

According to FBR, the volume of shares available for drawdown is limited to 1,000 per cent of the average daily trading volume over the preceding 15 trading days, with GEM having the option to subscribe for between 50 per cent and 200 per cent of the requested volume.

Each drawdown is priced at 90 per cent of the average daily volume-weighted average price (VWAP) over a 15-day pricing period, with FBR able to set a minimum drawdown price.

The company also confirmed it will issue options to GEM to purchase up to 450 million shares at an exercise price of AUD 0.01, with a three-year term. A facility fee of 1.8 per cent, payable in cash or shares, and legal fees of up to AUD 40,000 will also apply.

FBR said it has appointed Peak Asset Management as its corporate advisor for the facility. The company stated that the funds raised will support ongoing commercialisation of its Hadrian X and DST-enabled automation technology platforms, as well as research and development initiatives to expand its intellectual property portfolio.

“With this funding initiative in place, FBR has the capital resources required to deliver on the Company’s stated growth strategy,” said FBR Chief Executive Officer Mark Pivac.

“This includes realisation of the multiple commercial opportunities now available to FBR including the innovative Hadrian X and DST-enabled automation solutions technology platform – both in building construction and exciting new verticals like ship-building.”

FBR said the SSF forms part of a broader capital strategy to transition the company into a sustainable commercial business and further its reach into global markets.

“The success of these projects will demonstrate commercial viability of FBR’s product offering,” Pivac said. “This funding will also be used for the development and commercialisation of R&D projects to further expand and monetise FBR’s IP portfolio. Thus capitalising on the already large and growing addressable market for robotic products developed from the Company’s technology platform.”

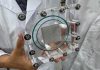

FBR noted that its newest innovation, the DST-enabled welding robot ‘Mantis’, is aimed at delivering automation efficiencies across heavy industries such as mining, large-scale fabrication and shipbuilding.

“This new funding facility is part of an overall funding strategy,” Pivac added. “We look forward to updating the market on further commercialisation strategy deliverables over coming months.”

The content of this article is based on information supplied by FBR Limited. For more information, please refer to the official company announcement and communications from FBR. Please consult a licensed and/or registered professional in this area before making any decisions based on the content of this article.