The overall Ai Group Australian Industry Index has plummeted 12.5 points to -22.4 points in November, signalling strong contractionary conditions.

This marks the nineteenth consecutive month indicating contraction, underscoring the persistent challenges faced by industries, Ai Group said in a news release.

The activity/sales indicator, a crucial metric, experienced a substantial drop of 12.8 points to -29.6, indicating a pervasive contraction across industries in the Ai Group Australian Industry Index.

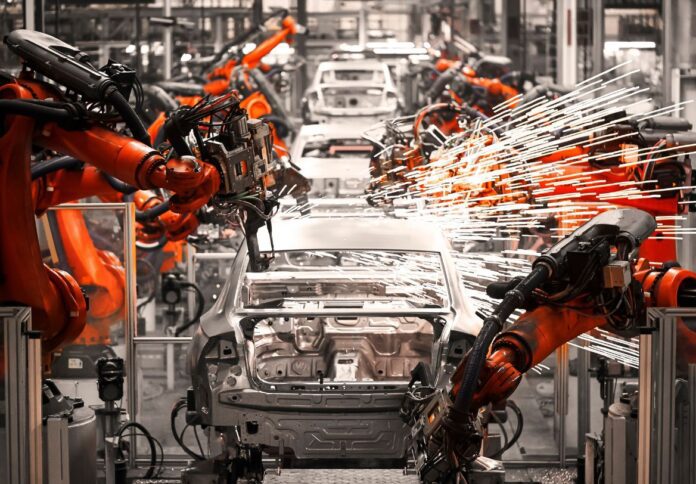

In particular, the Australian PMI for all manufacturing dropped by 4.4 points further into contraction (-25.3), with trends negative since September 2022.

The Australian PCI for construction fell back into negative territory at -22.2, marking the lowest monthly score since August 2021.

Upstream manufacturing indicators exhibited a mixed scenario, with chemical manufacturing experiencing a recovery trend, while minerals & metals and machinery & equipment faced contractionary pressures.

Labour shortages and cost pressures were cited as common challenges across various industries, impacting supply chains, order volumes, and overall business outlook.

Employment, while showing a slight recovery (+3.6 gain), remains in mild contraction since Easter. Labour shortages, especially for skilled roles, continue to impede substantial employment growth.

New orders registered a notable decline of 12.6 points to -29.9 in November, signaling a broader contraction since March 2023. Many survey respondents reported a slowdown in orders, with some noting stability.

The input volumes indicator witnessed a sharp decline of 32.8 points to -20.3, reflecting falling volumes in orders as businesses faced slowdowns. Several industry sectors grappled with supply chain challenges during this period.

Input prices modestly rose in November, while sales prices and average wage indicators decreased. Sales prices recorded their lowest result since October 2020, contributing to a widening gap of 49 points between input and sales prices, intensifying pressure on industrial margins.

The average wages indicator fell slightly, standing at +30.5, indicating persistent market pressures for wage growth despite the overall economic downturn.

Furthermore, despite a marginal uptick of 1.2 points in November, the business-oriented services indicator continued to depict contraction, registering at -22.4.

This indicator encompasses utilities, technical services, and supply chain/transport providers. Since early 2022, the business services index has consistently shown a declining trend.

Companies in the services sector noted that customers are hesitating to make investment decisions, attributing this caution to market uncertainty and heightened cost pressures.