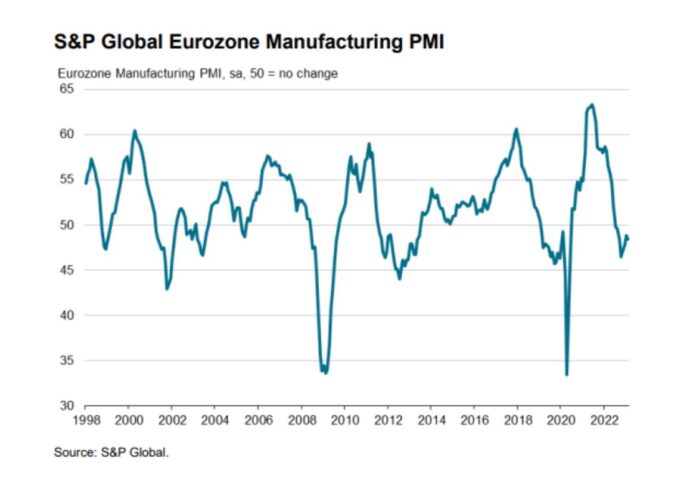

The euro area manufacturing purchasing managers’ index (PMI) stood at 48.5 in February, falling slightly from 48.8 in January, while the manufacturing output index nudged above the neutral mark to reach 50.1, up from 48.9 in January.

The index was pulled lower by the sub-components for suppliers’ delivery times, which showed a considerable easing of supply chain pressures and stocks of purchases indicating the sharpest decline in preproduction inventories since May 2021, according to final data released by S&P Global.

Together, these two factors balance out the beneficial effects that the output, new orders and employment indices had on the headline measure.

The single currency area’s manufacturing output volumes were largely constant in February, breaking an eight-month trend of declines.

The biggest decrease in supplier delivery times since May 2009 occurred in February, alleviating cost pressures experienced by goods makers.

According to the report, new orders decreased for a tenth consecutive month as client destocking, inflation, and overall economic uncertainty hurt sales results.

Meanwhile, four of the eight nations in the eurozone that the poll is tracking—which together make up about 89 per cent of the region’s manufacturing activity—recorded Manufacturing PMIs that were in the growth range.

The operating conditions of Italian goods makers improved the fastest in February, with their individual PMI reaching a ten-month high.

While Ireland and Spain only saw slight month-over-month gains, Greece experienced a similar strength upturn. Germany and France, considered to be the “core” of the euro area, witnessed manufacturing PMIs drop even lower below the 50.0 mark.

“A marginal expansion of output reported by Eurozone manufacturers in February is welcome news in representing the first increase since last May and a further improvement in the underlying trend from the low seen back in October,” commented Chris Williamson, chief business economist at S&P Global Market Intelligence.

He added that demand will need to climb higher in the upcoming months if production growth is to be sustained, breaking the reliance on backlogs of work.