The South Australian government has come up with a comprehensive plan that will help mitigate the impact of Holden’s closure by 2017.

On Monday SA Premier Jay Weatherill announced that $34.75 million in capital works projects would be brought forward to maintain economic momentum in the State as it faces the loss of the car maker.

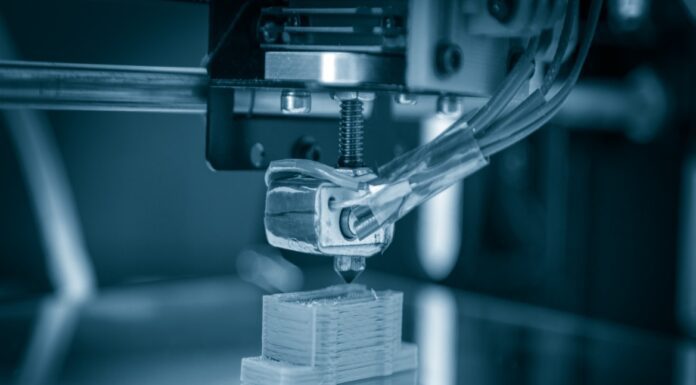

Mr Weatherill released the broad terms of the response, which is nearing its consultation phase soon. It centers on five key areas including retraining and supporting workers who are set to lose their jobs, supporting suppliers in order to help them diversify and accelerating the move to advanced manufacturing. The government also plans to attract new industries and support existing enterprises, and demand for more financial aid from the federal government.

“The impact of Holden’s decision to close starts at Elizabeth but extends well beyond it,” Mr Weatherill said in a media release.

“All of the measures we will take are designed to make sure that we stand by every worker, every street and every suburb affected.”

“Up to 13,000 jobs are at risk so it is crucial that Government takes responsibility for caring for them and equipping them to find new jobs.”

The capital works projects have already been broken down into various transport and infrastructure projects which will receive $12.45 million, and various SA Water projects worth $22.30 million. South Australian companies will have the opportunity to tender for the projects through a targeted procurement process.

“These projects will create South Australian jobs, generate activity and provide a platform for local companies to grow and become more competitive,” Mr Weatherill said.

Last week the Premier met with Australian banks in Sydney to reassure them that South Australia’s economy will remain strong amidst Holden’s decision to shut down manufacturing operations in the country.

Mr Weatherill stressed the importance of the banks’ continued support for car component producers who are seeking financing to restructure their operations.

“What we don’t want is for banks to see `car industry’ next to a particular component supplier and say that we’re not going to lend to them,” he said, quoted in a report on Nine MSN.