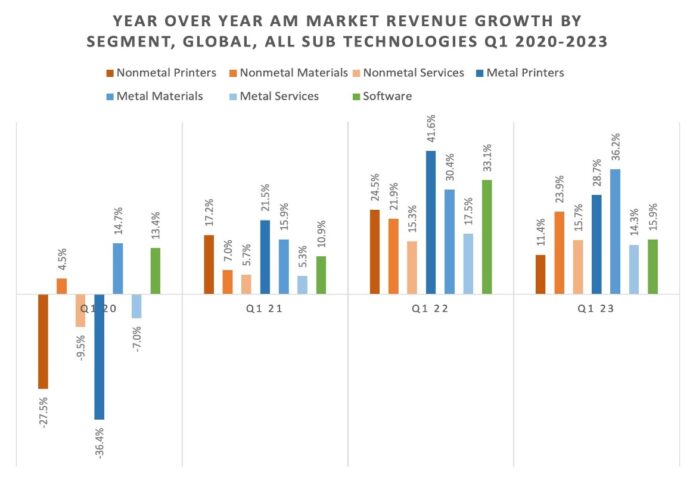

Despite growing economic difficulties in the additive manufacturing (AM) global market, the first quarter of 2023 saw double-digit sequential growth to USD 3.7 billion (AUD 5.5 billion) compared to USD 3.4 billion (AUD 5 billion) during the same period of the prior quarter in, according to latest data from SmarTech Analysis.

Figures showed that while hardware investments and print material consumption were practically unchanged on a sequential basis, the ongoing usage of AM services in the post-pandemic era fueled market expansion until 2023.

Year-over-year results were also encouraging across all sectors, with metal 3D printing markets increasing by more than 20 per cent and polymer 3D printing markets increasing by 17 per cent.

“While some industry players painted a more negative picture of the market’s conditions to start the year, the AM market continues to grow at the edges because the value proposition in additive hasn’t really changed despite the economic waves of the last two years,” said Scott Dunham, SmarTech Analysis EVP in Research.

However, Dunham emphasised that the biggest brands are discovering that size is tough to acquire.

“We believe this is because initial adoption barriers for AM are low, while significant, game-changing adoption is difficult to achieve for customers,” he noted

This indicates how crucial customer-facing consulting groups, adaptable machine configurations, and a solid executive and corporate structure are to the success of an AM company, Dunham stated.

Other findings show how the use of AM in general industrial and energy markets drove some public application highlights.

In particular, by the end of the forecast period, the ‘General Industrial’ sector in SmarTech’s metal additive market tracking database is anticipated to have consumed the second-most metal powder from the use of AM.

This is only behind the aerospace sector, for use in power plants, filtration, and producing customer-specific cutting tools.

In the previous few years, one of the main development characteristics of the PBF market has been an expansion in the industry’s edges, driven by new entrants, but not nearly as strong continuous growth from the core rivals.

According to SmarTech, this tendency has a lot to do with retaining knowledgeable personnel and acquiring new customers.

For more information on the report, you may visit this link.